The biggest impact of foreign exchange in procurement doesn't just come from finding better exchange rates.

The biggest impact for businesses with import or export contracts is found within the procurement contract. Are you asking the key questions?

THE RIGHT QUESTIONS

What exchange risk is worn by the business?

What exchange rate risk has been passed to the vendor to price in?

Which party is in charge of determining the exchange rate?

Are there FX clauses forcing a re-price?

Are benchmark exchange rates sourced from retail or wholesale data?

Are future cash-flows priced at spot rates or the relevant forward rates?

SEEKING TRANSPARENCY

Suppliers and vendors often apply significant margins to invoices priced in a currency different from their own. This is also found when domestic resellers source goods from overseas.

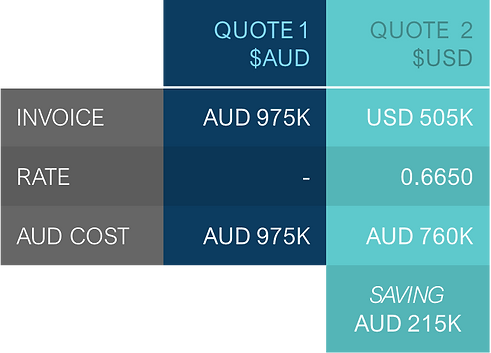

If a tender/quote needs to be in a currency different to the origination currency, also seek a quote in the supplier’s preferred currency. This allows the supplier to provide an alternative quote which eliminates currency risk passed to them.

Two quotes will increase transparency and provide you with an opportunity to assess which option is cheaper at prevailing exchange rates.

Contact us to find out more about accurately applying the right forward exchange rates to match milestone payment dates and how to best manage any market risks.

Request a call

Reach out to one of our global teams to discuss enhancing international payments, risk management and procurement contract optimisation.